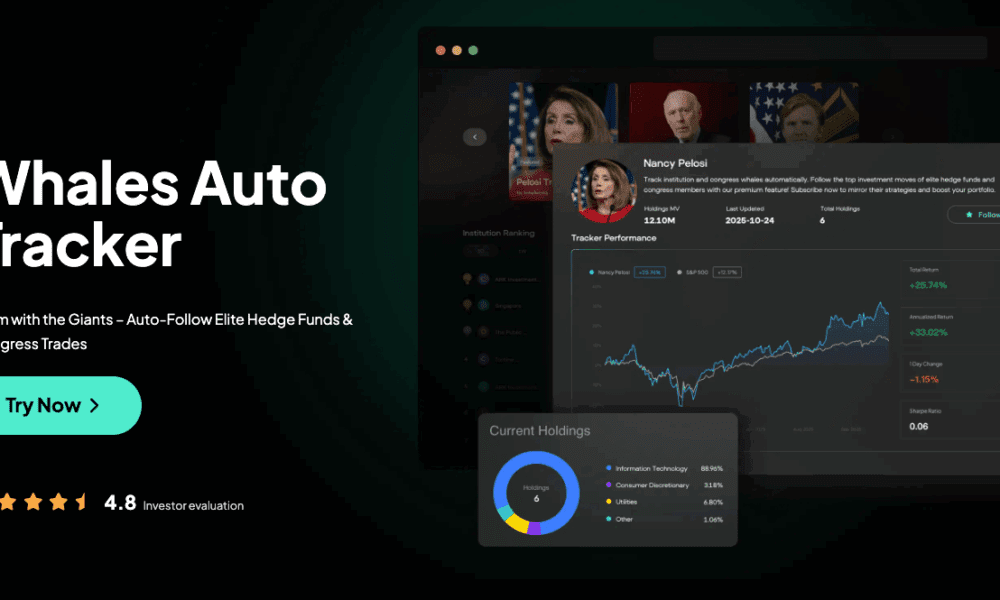

Whales Auto Tracker: Ride the Waves of Smart Money Moves with Intellectia.ai

In today’s fast-paced markets, retail investors often feel left behind — missing out on big moves by elite hedge funds or influential lawmakers simply because filings are scattered, delayed, and hard to interpret. That’s where our new feature, Whales Auto Tracker, comes in. Designed by Intellectia.AI, Whales Auto Tracker lets you automatically track institutional and congressional “whales,” giving you the power to mirror their moves with minimal effort. Missing out on the trading signals from top investors like Warren Buffett and influential Congress members could cost you thousands—now, you don’t have to bear that loss.

What Is Whales Auto Tracker?

Whales Auto Tracker is an automated tool built to track the top holdings of major hedge funds (think ARK Invest, Berkshire Hathaway) and U.S. Congress members. It uses publicly available 13F disclosures and disclosures by lawmakers to build simulated portfolios, weighted by the actual positions these whales hold. Once you follow a whale, the tool rebalances the simulated portfolio monthly, updates performance daily, and sends trade alerts — all without needing deep financial expertise.

With a user-friendly interface, real-time performance curves, and clear metrics like total return, annualized return, Sharpe Ratio, and daily returns, Whales Auto Tracker makes “whale watching” as simple as clicking a button.

Why Whale Watching Matters

In financial jargon, “whales” are large, influential investors — hedge funds, institutions, and sometimes well-connected insiders — whose trades can sway markets Historically, tracking these big players has been the territory of experts, with access to filings, analytics tools, and vast resources.

But when these whales move — buying or dumping large amounts of stock — markets can react swiftly. For retail investors, keeping an eye on institutional flows can offer early signals for potential trends, sector rotations, or upcoming volatility. Tools that track whale-size trades, institutional filings or congressional disclosures provide a competitive edge, helping investors anticipate market moves that others might only see in hindsight.With Whales Auto Tracker, you’re not just reacting — you’re riding the waves of big moves.

Key Benefits of Whales Auto Tracker

✅ Effortless Access to Smart Money Moves

Rather than manually sifting through SEC filings or congressional disclosures (often delayed or fragmented), Whales Auto Tracker consolidates all relevant data and translates it into tangible, actionable portfolios.

📈 Simulated Portfolios with Daily Performance Tracking

Each whale creates a simulated full-cash portfolio, rebalanced monthly, with daily updates vs. a benchmark (e.g. S&P 500). See how top funds perform over 1 M, 3 M, 6 M periods — all in one place.

🔔 Instant Alerts on Buys/Sells

Get push or email notifications when a whale makes a move — for example, “Berkshire Hathaway sold NVDA at $138.50”. For followed whales you’ll have access to full trade history, adjusted weights, P&L, and fill prices. No more chasing filings; you get the updates automatically.

📊 Beginner-Friendly & Transparent

You don’t need to be a finance pro. The tool offers free previews and simple watchlist features. Paid details unlock depth — but even on free mode, you get a window into what the pros are doing.

🔄 Diversified Strategies with Blended Whale Tracking

You can follow multiple whales — hedge funds, lawmakers, diversified strategies — combine their simulated portfolios, and monitor blended exposure. This reduces risk and gives you diversified exposure to top institutional strategies.

Real Use Cases: From Newbies to Seasoned Traders

● Beginner Investors: If you’re new and don’t have time to research dozens of companies, Whales Auto Tracker offers a hands-off, straightforward way to participate in large-scale strategies, using the moves of elite investors as a compass.

● Congress Trade Followers: For those tracking insider-related trades, the tracker gives simulated portfolios based on newly disclosed congressional trades (with daily rebalancing and performance curves), signaling potentially undervalued or hot-growth opportunities early.

● Diversified Whale Watchers: Experienced investors can follow 3–5 whales simultaneously for blended exposure — mix hedge funds with congressional trades and sector-specific strategies, balancing risk and tapping multiple institutional playbooks.

Why Whales Auto Tracker Stands Out

● Comprehensive Data with Minimal Effort — No need to dig through filings, interpret disclosures, or manually build models. Whales Auto Tracker does the heavy lifting.

● Real-Time Alerts & Easy Monitoring — Notifications, daily net-value curves, and performance metrics make it easy to stay ahead of the curve.

● Accessible for All — From beginners to advanced investors, the interface and features simplify institutional-level tracking.

● Diversification & Flexibility — Combine multiple whales and strategies for a diversified portfolio without overwhelming manual work.

Conclusion — Ride the Institutional Wave with Confidence

If you’ve ever wished you could see what the pros are doing — hedge funds, elite investors, lawmakers — without wading through piles of filings and financial jargon, Whales Auto Tracker is the tool for you. It democratizes institutional-level investing intelligence, giving retail investors a real shot at mirroring smart money moves.

With simulated portfolios, real-time performance tracking, and instant alerts, you don’t just follow the whales… you ride with them. Ready to catch the next big wave?

Source: Whales Auto Tracker: Ride the Waves of Smart Money Moves with Intellectia.ai