Maximizing Tax-Free Income and Withdrawals In Retirement

There’s a lot of enthusiasm for Roth IRA conversions and Mega Backdoor Roth IRAs—and for good reason. Paying taxes upfront on your retirement accounts can be a savvy move, especially if you’re in a mid-to-lower federal income tax bracket, as it allows for tax-free withdrawals in the future.

That said, thanks to the latest standard deduction amounts and income thresholds for paying no long-term capital gains tax, more Americans now have the opportunity to make larger tax-free withdrawals from their taxable brokerage accounts. For 2025, that tax-free income amount is up to $68,860 for a single person and $126,700 for a married couple.

The vast majority of Americans could live comfortably in retirement on $68,860 or $126,700. After all, the median individual income in our country is about $43,000 before taxes.

This article will show you how to earn and withdraw six figures while paying no taxes. I’ll also provide a guide on how much you should save for retirement if these income levels are sufficient for your needs. As I’m not a tax professional, just an enthusiast, feel free to challenge me and share some further insights if you are one.

Related: 2025 Federal Income Tax Rates And The New Ideal Income

A Taxable Brokerage Account Increases In Importance

For those pursuing FIRE, growing your taxable brokerage account is crucial, as it generates the passive income you’ll rely on in retirement. Unlike retirement accounts, there are no contribution limits, and no required minimum distributions. Additionally, you can take tax-free withdrawals, as you’ll see below.

If you’re planning to retire early, I recommend maxing out your tax-advantaged retirement accounts each year while working to grow your taxable brokerage account to three times the size of your tax-advantaged accounts. Achieving this balance can set you up for financial freedom. Since starting Financial Samurai in 2009, I’ve encountered many people who neglected their taxable brokerage accounts, which ultimately left them constrained.

Below is a case study showing how much you might aim to accumulate in taxable investments alongside your tax-advantaged accounts. While this may seem like a stretch goal for some, it’s my recommended framework for building long-term wealth. At age 50, you likely won’t have to pay any income taxes.

Standard Deduction Limits And Income Thresholds For 0% Tax

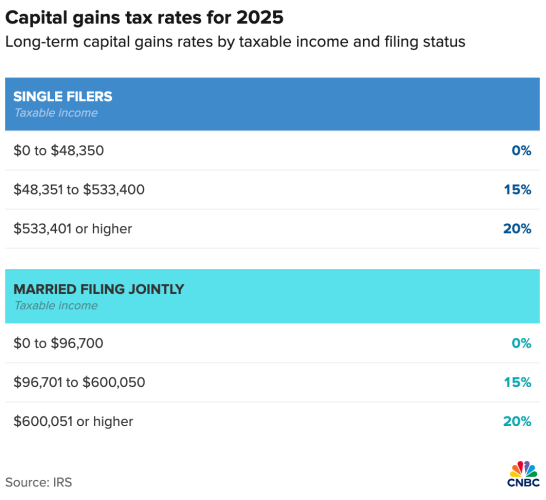

To understand how to achieve tax-free withdrawals from taxable brokerage accounts we must first know two key factors:

- The latest standard deduction amounts: $15,000 for singles and $30,000 for married couples for 2025.

- The income threshold for the 0% tax bracket on qualified dividends and long-term capital gains: $53,850 for singles and $96,700 for married couples.

By adding the standard deduction to the income threshold based on your marital status, we can calculate the tax-free income and withdrawal limits. For 2025, these limits are:

- $68,850 for singles

- $126,700 for married couples filing jointly

However, to avoid paying taxes on $68,850 or $126,700, the composition of your income is crucial. Let’s illustrate this with an example for a married couple filing jointly. Always check the latest standard deduction and income threshold amounts, as they change every year.

Meet Chris and Taylor – Semi-Retired And Consulting Part-time

Chris and Taylor are in their early 60s, semi-retired, and living off a mix of passive income from investments and part-time consulting work. They’ve built a $2 million taxable retirement portfolio during their working years and now focus on optimizing their tax situation to live comfortably.

How They Earn Tax-Free Income in 2025

- Standard Deduction

The standard deduction for married couples filing jointly is $30,000 in 2025. This deduction shields the first $30,000 of their income from federal income taxes. - 0% Long-Term Capital Gains Tax Rate

The 0% tax rate on long-term capital gains and qualified dividends applies as long as their taxable income (after deductions) remains below $96,700. - Combining the Two

By combining their standard deduction with the 0% capital gains tax threshold, Chris and Taylor can earn:- $30,000 in ordinary income (e.g., consulting income or IRA withdrawals)$96,700 in long-term capital gains or qualified dividendsThis gives them a total tax-free income of $126,700 in 2025.

Chris and Taylor’s Part-Time Consulting

Chris and Taylor earn $30,000 from part-time consulting—a pursuit I highly encourage for semi-retirees or retirees to stay mentally active and engaged with society. This ordinary income is fully offset by their $30,000 standard deduction, meaning they pay 0% federal tax on their consulting income.

After listening to my podcast interview with Bill Bengen, the creator of the 4% Rule, they feel comfortable withdrawing between 4% to 5% annually from their $2 million taxable portfolio. This year, they sell investments, realizing $96,700 in long-term capital gains. Because their taxable income (after accounting for the standard deduction) matches the $96,700 threshold for the 0% federal long-term capital gains tax rate, they owe 0% federal tax on these gains as well.

However, Chris and Taylor reside in California, where all capital gains and dividends are taxed as ordinary income. At their marginal California state income tax rate, they owe $5,365 in state taxes on their combined income of $126,700, resulting in an effective state tax rate of 4.23%. Not bad, but something to consider.

$126,700 Tax-Free Income Is Equivalent To ~$170,000 In Wages

To walk away with $126,700 after taxes, you would need to earn approximately $170,000 in gross income at a 25% effective tax rate (including FICA taxes), assuming no state income taxes. If you live in states like California, New Jersey, or New York, where state taxes significantly impact your take-home pay, you’d likely need to earn closer to $180,000 in gross income to achieve the same after-tax amount.

For Chris and Taylor to avoid paying state income taxes entirely on their $126,700 income, relocating to one of the nine no-income-tax states—such as Texas, Florida, or Tennessee—is one solution. Alternatively, states like Illinois, Pennsylvania, or South Carolina, which tax income more favorably or exclude certain income types, could also provide meaningful tax savings depending on how their income is structured.

This gross income comparison underscores the value of saving and investing for retirement. Diversifying retirement funds through a Roth IRA or Mega Backdoor Roth IRA is another effective strategy, depending how rich you think you’ll be.

However, if you anticipate staying below certain net worth thresholds in retirement, the Roth IRA’s benefits may diminish, as you could achieve tax-free withdrawals from taxable brokerage accounts regardless.

$3 Million Retirement Portfolio Threshold To Start Worrying About RMDs

One challenge that some wealthy or frugal retirees face is the requirement to take Required Minimum Distributions (RMDs) starting at age 73, as mandated by the SECURE 2.0 Act. These RMDs, which are treated as ordinary income, can potentially push retirees into a higher tax bracket.

However, if you don’t anticipate retiring with more than $3 million in your 401(k) or IRA as a married couple, you’re likely safe from paying significant taxes in retirement. This safety comes from the standard deduction and the increasing income thresholds for 0% tax on long-term capital gains. Even when factoring in the average Social Security income for a couple of $40,000 in today’s dollars, many retirees can still manage a relatively low tax burden.

For singles, shoot for a retirement portfolio of $1.5 million and feel safe from paying taxes due to RMDs. $1.5 million is also $200,000 more from how much workers in their 50s said they needed to retire comfortably in a 2023 Northwestern Mutual survey. The retirement portfolio threshold amounts can be indexed to inflation over time. But these are two easy to remember figures if people want to shoot for net worth goals.

RMD Example With Little-To-No Taxes To Pay

Below is a graphical example of a retiree forced to take RMDs at age 73 with a $3 million 401(k). The calculation assumes:

- A withdrawal rate of 3.8%, as determined by the Uniform Lifetime Table calculation.

- No additional contributions are made after retirement.

- An annual investment growth rate of 5%.

By the time you turn 73, the income threshold for the 0% tax rate will likely be higher than the RMD amounts discussed above. Additionally, the standard deduction could potentially eliminate most, if not all, of your Social Security income from being taxed.

In addition, to lower your RMD amounts, you can obviously start withdrawing sooner than age 73.

On the other hand, if you anticipate having retirement portfolios well over $1.5 million / $3 million, you’ll have a greater incentive to take advantage of Roth IRA conversions and Mega Backdoor Roth IRAs earlier in your career. The best time to implement these strategies is when your income is at its lowest, such as after a layoff or during an early retirement phase.

Summary Of Tax-Free Withdrawals From Retirement Accounts

To achieve tax-free withdrawals and income in retirement, retirees should stay within the standard deduction and 0% tax bracket for long-term capital gains and qualified dividends. In 2025, this means keeping taxable income under $68,850 (single) or $126,700 (married), which includes the standard deduction ($15,000 single, $30,000 married) and the tax-free threshold for capital gains/dividends.

Required Minimum Distributions (RMDs) from 401(k)s and IRAs start at age 73 and are taxed as ordinary income. To avoid higher taxes, limit pre-tax account balances to $1.5 million (single) or $3 million (married), and consider Roth conversions earlier in retirement.

Social Security should also be managed to avoid taxes. Up to 85% of benefits can be taxed if combined income exceeds $34,000 (single) or $44,000 (married). By balancing RMDs, dividends, and capital gains, retirees can enjoy tax-free income.

Worst case, if you accumulate more money than expected, you’ll just pay more taxes—not a bad problem to have!

Readers, did you know that Americans can now earn and withdraw so much without paying any taxes? If that’s the case, why are some people still trying to accumulate way more than $1.5 million per person for retirement?

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise because money is too important to be left up to the inexperienced.